‘Tariffs may boost US manufacturing & consumption’

MUMBAI: Blackstone chairman & CEO Stephen Schwarzman said that the new tariff regime in the US has the potential to boost growth and increase American consumption demand.

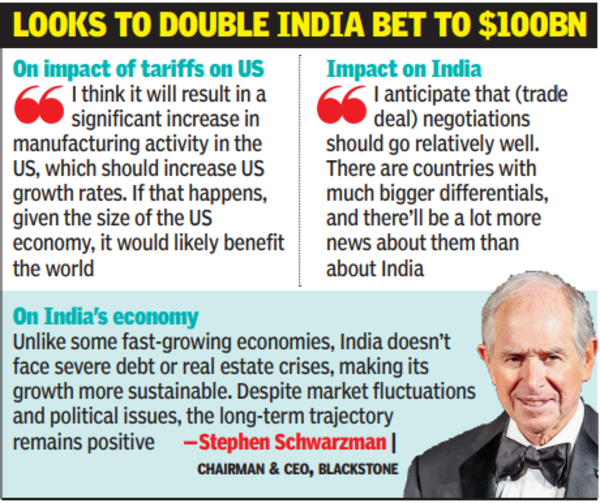

“I think it is too early to tell because you don’t know how this is all going to work out. I think it will result in a significant increase in manufacturing activity in the US, which should increase US growth rates. If that happens, given the size of the US economy, it would likely benefit the world. A faster-growing US can drive higher consumption, but this is just one possible scenario,” said Schwarzman.

“What the US is trying to achieve is to have a code on tariffs with each major country; that way, the balance of trade will be determined by how good and cheap your product is. The theory is there shouldn’t be anything standing in the way of that sort of decision, making it easy for a customer to make a choice” said Schwarzman who is visiting India.

Looks to double India bet to $100 billion

According to Schwarzman, India is “quite well placed” in tariff talks. “Very few countries in the world have had that treatment, and India has already made some changes. I anticipate that negotiations should go relatively well. There are countries with much bigger differentials, and there’ll be a lot more news about them than about India. That’s a good place to be.” He added that the concern in India appeared to be arising because of the uncertainty.

Schwarzman, who chaired the President’s Strategic and Policy Forum during Trump’s first term, said PM Modi had a “very good” meeting with the US President, where they agreed to a trade deal.

Blackstone, with over $1 trillion in assets globally, aims to double its India exposure to $100 billion. It is India’s largest foreign company, real estate owner, and private equity firm.

Schwarzman said India needs more infrastructure investment and better project completion. Coordination between the central and state govts remains a challenge, as foreign investors find the approval process complex. A more transparent tax code would also help, as investors sometimes face unexpected issues.

Schwarzman, who last visited India just before the pandemic, said the country has always been a market of “tremendous opportunity.” The firm plans to expand into credit and infrastructure, both key global business areas. “India is the fastest-growing major economy in the world. While challenges exist, they are manageable compared to those in other markets. Unlike some fast-growing economies, India doesn’t face severe debt or real estate crises, making its growth more sustainable. Despite market fluctuations and political issues, the long-term trajectory remains positive,” he said.

Schwarzman remained optimistic about India’s economic growth despite market correction. “ Some believed the market was overvalued, and a correction was expected. When that happens, people get nervous. Growth rates have been among the highest globally, and I don’t see anything that will change that in the near to intermediate term.”