Indian stocks look attractive! Sensex expected to recover lost ground against EM peers in 2025 – top 10 reasons

Indian equity benchmark indices, BSE Sensex and Nifty50, may have crashed from their September 2024 peaks, but the market still looks attractive in the long-term, says Morgan Stanley. In its latest report on ‘India Equity Strategy and Economics’, Morgan Stanley says that India’s long-term story remains intact, adding that its sentiment indicator is in ‘strong buy territory’ for Indian equities.

“A likely positive shift in fundamentals is not in the price – we expect India to recover lost ground against its peer group through the rest of 2025,” says Ridham Desai, Equity Strategist at Morgan Stanley.

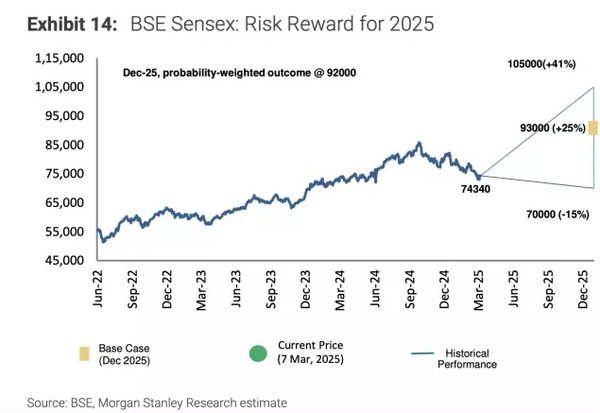

Morgan Stanley maintains its Sensex projection of 105,000 points for December 2025. The financial institution’s team of strategists and economists, under Ridham Desai, observed that India’s comparative earnings growth is showing an upward trend, even when considering conservative consensus estimates. They have characterised India as ‘A stock pickers’ market’.

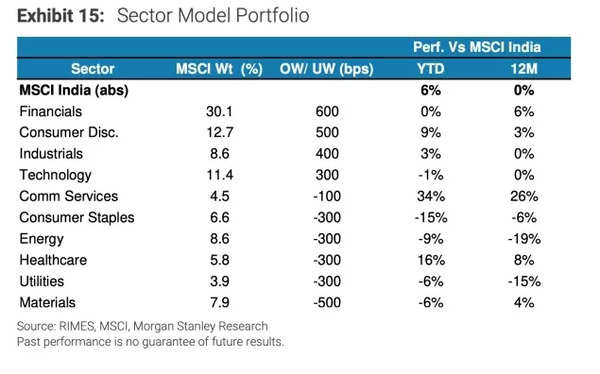

Sectors in Focus

According to the report, India’s earnings projections surpass market consensus expectations. The country’s comparative earnings trajectory shows an upward trend, even when considering cautious consensus predictions. Current valuations stand at their most favourable levels since the Covid pandemic period, it says.

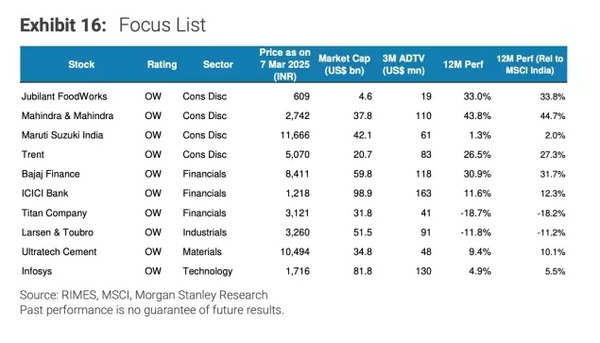

Stocks in Focus

“The market has ignored the RBI’s policy pivot, and a strong budget from the government, among other positive developments since early February. India’s low beta characteristic make it an ideal market for the uncertain macro environment that equities are dealing with. Importantly, our sentiment indicator is in strong buy territory,” the report says.

Why Morgan Stanley is positive about India

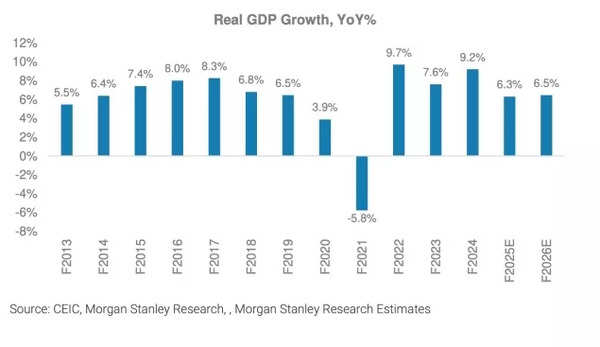

- The GDP figures for quarter ending Dec-24 confirm the recovery trajectory, following the lowest point in quarter ending Sep-24. The outlook suggests a widespread consumption recovery, with urban demand set to increase due to income tax reductions, complementing the strong rural consumption patterns. Despite global economic uncertainties and geopolitical challenges, Morgan Stanley anticipates GDP growth of 6.3% YoY in F2025, followed by 6.5% in F2026-27.

Real GDP Growth Projection

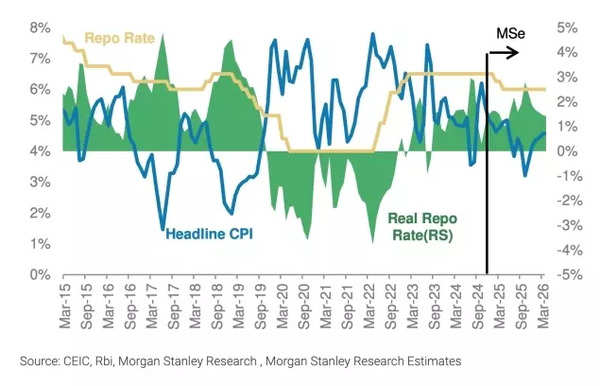

- The headline CPI has declined to approximately 4% from its recent peak, influenced by declining food prices, whilst core inflation remains stable. Food prices, comprising ~46% of the CPI basket, are expected to decrease further, influencing the overall inflation outlook. The report projects inflation will reach ~4.3% YoY in F2026-27, down from 4.9% YoY in F2025.

- The RBI has initiated comprehensive easing measures across rates, liquidity and regulations. Following the repo rate reduction in February’s policy meeting, Morgan Stanley anticipates an additional 25 bps cut during the April policy session in this easing cycle.

Further repo rate cuts expected

- The Budget focuses on strengthening economic recovery through consumption stimulus via income tax reductions and increased capital expenditure allocation, whilst maintaining fiscal discipline to ensure macroeconomic stability.

Indian Stock Markets Show Signs of Being Oversold – Top 10 Factors

India is anticipated to regain its position relative to Emerging Markets in 2025, supported by several fundamental factors. These include robust macro stability with better terms of trade, reducing primary deficit and stabilising inflation; consistent annual earnings growth of 15-19% over the coming 3-5 years, driven by private capital expenditure, corporate balance sheet expansion and increased discretionary spending; alongside reliable domestic risk capital.

According to Morgan Stanley, the equity market continues to overlook good news (as it always does when its psychology is bad): There have been some good developments over the past five weeks which include:

1) A budget focused on capital expenditure that progressively reduces the primary deficit. The government has managed this equilibrium through reduced subsidy spending, which should help control inflation. The decreased primary deficit will create space for private sector credit and investment activities.

2) The Reserve Bank of India’s transformation encompasses three aspects: rate reductions, enhanced liquidity provisions and eased regulatory requirements. The RBI’s policy decisions could potentially intensify the economic deceleration in 2024. However, it appears probable that credit expansion will improve from current levels, which should boost growth rates compared to the previous two quarters.

3) Taxation policy changes designed to enhance international capital inflows. Foreign investment portfolios currently stand at their lowest levels since record-keeping began.

4) Strategic partnerships with the United States encompassing advanced technology, energy sector cooperation and defence collaboration. The potential impact of mutual tariffs appears minimal.

5) Crude oil prices have reached their lowest point in four years, potentially easing inflationary pressures and enhancing India’s trade position, consequently benefiting corporate profits.

BSE Sensex: Risk Reward for 2025

6) The US Dollar Index adjustment, coupled with India’s real effective exchange rate nearing equilibrium levels, is likely to attract overseas investors looking to acquire Indian assets.

7) Despite widespread institutional skepticism, retail investors have shown remarkable staying power. The steadfast retail participation reflects fundamental changes in household financial positions, a transformation that began in 2015.

8) Foreign Portfolio Investors’ debt flow patterns indicate growing confidence in India’s economic fundamentals and rupee stability.

9) The BSE Sensex’s return to November 2020 levels has created more favourable equity valuations when measured in gold ounces.

10) A significant decline in Morgan Stanley’s sentiment gauge has reached the robust buy territory – comparable to levels previously observed in September 13, October 08 and September 01.

However, Morgan Stanley cautions that should a global economic downturn/recession or near-downturn materialise, it would pose challenges to our outlook and prevent Indian equities from reaching peak levels in 2025.